Our Blog

|

While the rise of the internet and other forms of integrated media present numerous benefits to the world, they have some downsides as well. One of these that's applicable across numerous popular industries, including the real estate world: Myths are easier to create and spread. When you work with The Albright Team, led by Las Vegas native Kelly Albright, you get personalized, caring services that include several basic areas of expertise -- including correcting any of the silly myths you may have heard about this world before you contacted us. Sadly, there are a number of these out there; this two-part blog series will hit on all the most common real estate and realtor misconceptions, ensuring you have the proper information to move forward with your housing needs. Myth #1: All Realtors are the SameThis first myth simply couldn't be further from the truth. In reality, every single real estate agent has different specialties, talents and training. An agent who has been in the industry for two decades is going to have a different set of expertise than a new agent who has just finished their formal training, for example. Agents will also differ in areas like their number of clients, whether they work with buyers or sellers (or both), and several other areas. Myth #2: You Get a Better Deal Without an AgentThis is another myth that often comes up, and one that reveals a simple lack of understanding for how real estate agents are compensated. Agent commissions, both for buyer and seller agents, are paid by the seller and can often be as high as six percent of the sales price. As a buyer, this means you pay nothing for the numerous benefits you'll be receiving, which include experience in the local area, access to tools that help you get the best possible price on your new home and someone who knows how to answer all of your questions. Myth #3: Any Home You See Online is AvailableMany people browse sites like Zillow and others to check on available homes in their area, but it's important to note that these sites aren't always 100 percent accurate. Often, the owners of these homes want to be present when interested buyers come calling, or they might have already accepted another offer.

Either way, it's always best to call our office directly and speak with an agent about whatever property you're considering; this is one of the key areas of value realtors help provide, in fact. We'll help you understand the various terms involved here and why some homes might be listed as "active," "new" or "contingent," among other possible listings. For more debunked myths in the real estate world, or to learn about any of our realtor services in Las Vegas, speak to the staff with The Albright Team today.

0 Comments

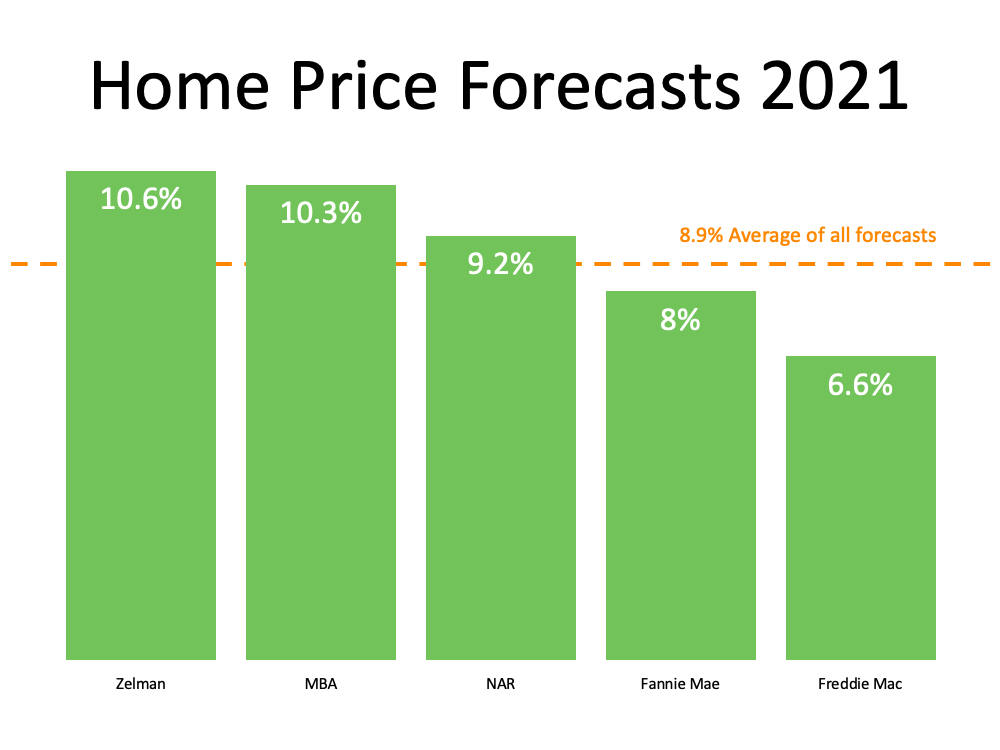

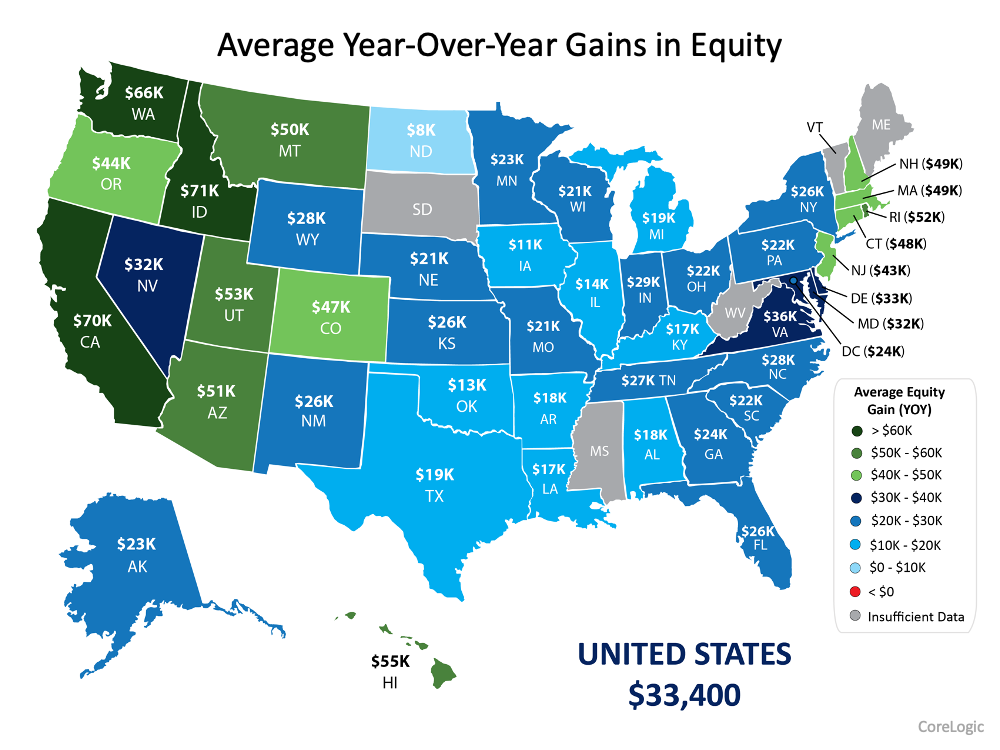

As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off a robust housing market in the first half of 2021, but what does the forecast tell us about what’s on the horizon for Las Vegas? Mortgage Rates Will Likely Increase, but Remain Low Many experts are projecting a rise in interest rates. The latest Quarterly Forecast from Freddie Mac states: “We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.” However, even as mortgage rates rise, the anticipated increase is expected to be modest at most, and still well below historical averages. Rates remaining low is good news for homebuyers who are looking to maximize their purchasing power. The same report from Freddie Mac goes on to say: “While higher mortgage rates will help slow the pace of home sales and moderate house price growth, we expect overall housing market activity will remain robust. Our forecast has total home sales, the sum of new and existing home sales, at 7.1 million in 2021....” Home Price Appreciation Will Continue, but Price Growth Will Likely Slow Joe Seydl, Senior Markets Economist at J.P. Morgan, projects home prices to continue rising as well, indicating buyers interested in purchasing a home should do so sooner rather than later. Waiting for rates or home prices to fall may not be wise: “Homebuyers—interest rates are still historically low, though they are inching up. Housing prices have spiked during the last six-to-nine months, but we don’t expect them to fall soon, and we believe they are more likely to keep rising. If you are looking to purchase a new home, conditions now may be better than 12 months hence.” Other experts remain optimistic about home prices, too. The graph below highlights 2021 home price forecasts from multiple industry leaders: Inventory Remains a Challenge, but There’s Reason To Be Optimistic Home prices are rising, but they should moderate as more housing inventory comes to market. George Ratiu, Senior Economist at realtor.com, notes there are signs that we may see the current inventory challenges lessen, slowing the fast-paced home price appreciation and creating more choices for buyers: “We have seen more new listings this year compared with 2020 in 11 of the last 13 weeks. The influx of new sellers over the last couple of months has been especially helpful in slowing price gains.” New home starts are also showing signs of improvement, which further bolsters hopes of more options coming to market. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), writes: “As an indicator of the economic impact of housing, there are now 652,000 single-family homes under construction. This is 28% higher than a year ago.” Finally, while it may not fundamentally change the market conditions we’re currently experiencing, another reason to be optimistic more homes might come to market: our improving economy. Mark Fleming, Chief Economist at First American, notes: “A growing economy in the summer months has multiple implications for the housing market. Growing consumer confidence, a stronger labor market, and higher wages bode well for housing demand. While a growing economy and improving public health conditions may also spur hesitant existing owners to list their homes for sale, it’s unlikely to significantly ease the super sellers’ market conditions.” Bottom Line As we look at the forecast for prices, interest rates, inventory, and home sales, experts remain optimistic about what’s on the horizon for the second half of 2021. Let’s connect today to discuss how we can navigate the market together in the coming months.  Building financial wealth and stability remains one of the top reasons Americans choose to own a home, and as a homeowner, your wealth often grows without you even realizing it. In a recent paper published by the Urban Institute, Home Ownership is Affordable Housing, author Mike Loftin illustrates how homeowners increase their equity and their wealth simply by making monthly mortgage payments: “The principal portion that reduces the loan balance builds the homeowner’s equity. In doing so, the principal payments behave like an automatic savings account. The principal payment is not money going out; it is money staying in.” But home equity – the difference between the value of your home and what you currently owe – isn’t just built through your monthly principal payments. Home price appreciation plays a vital role in growing your equity and, ultimately, your wealth. As Freddie Mac explains: “Homeownership has cemented its role as part of the American Dream, providing families with a place that is their own and an avenue for building wealth over time. This ‘wealth’ is built, in large part, through the creation of equity…Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.” Homeowners Continue To See Equity Increase CoreLogic recently published their latest Homeowner Equity Insights Report, and it shows continued growth in equity amidst record home price appreciation. The report provides several key takeaways, all of which point to rising wealth for homeowners:

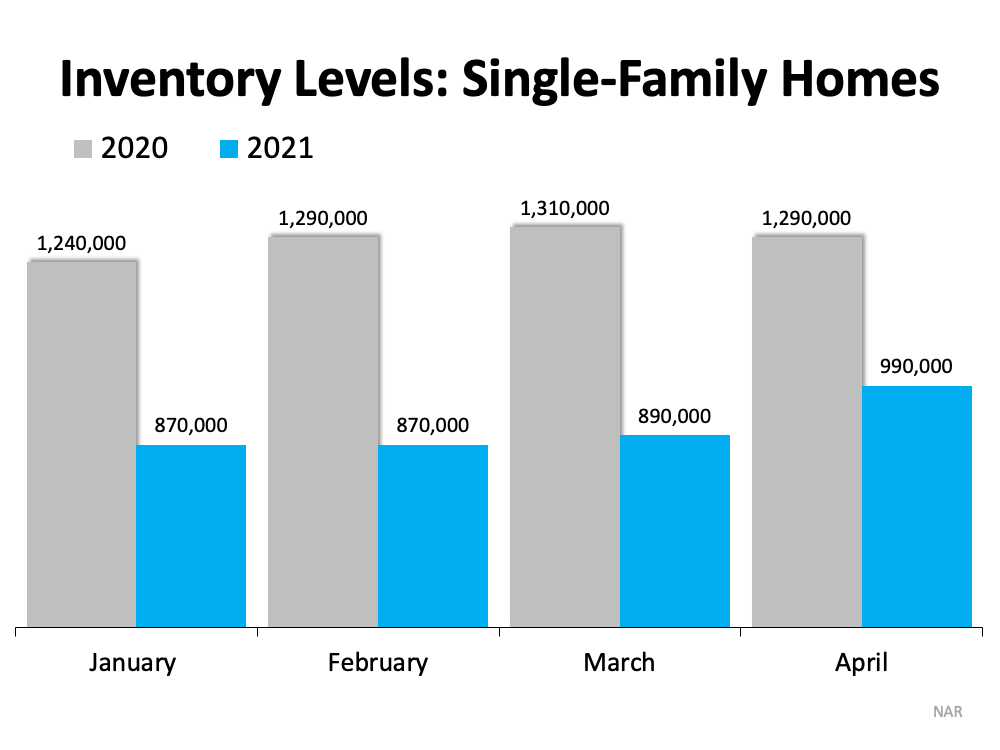

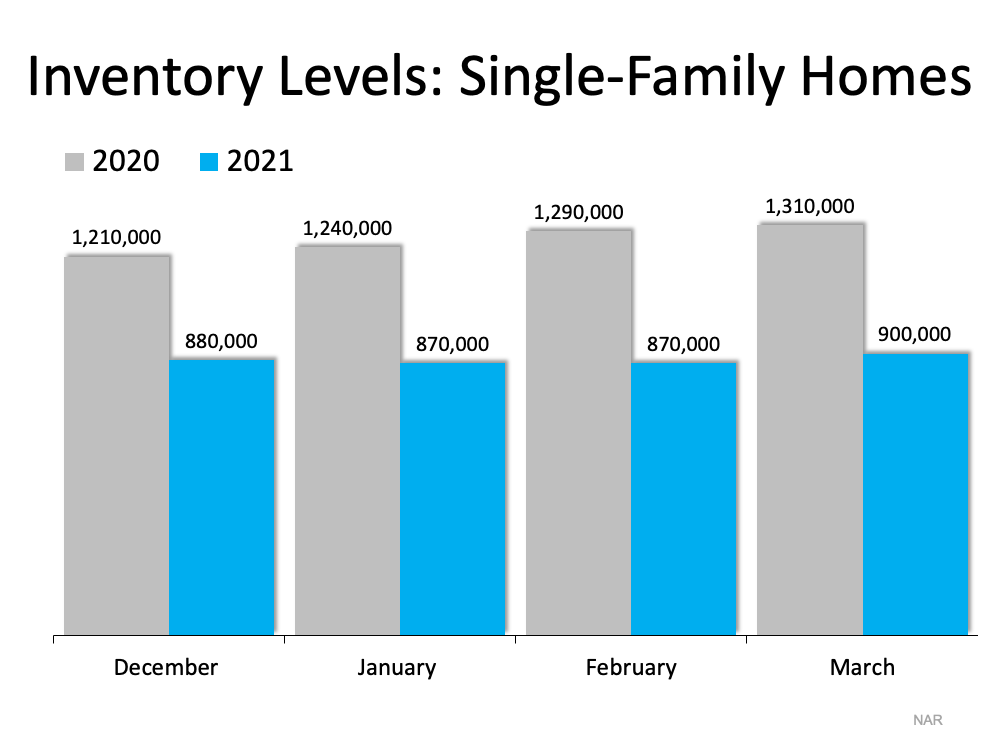

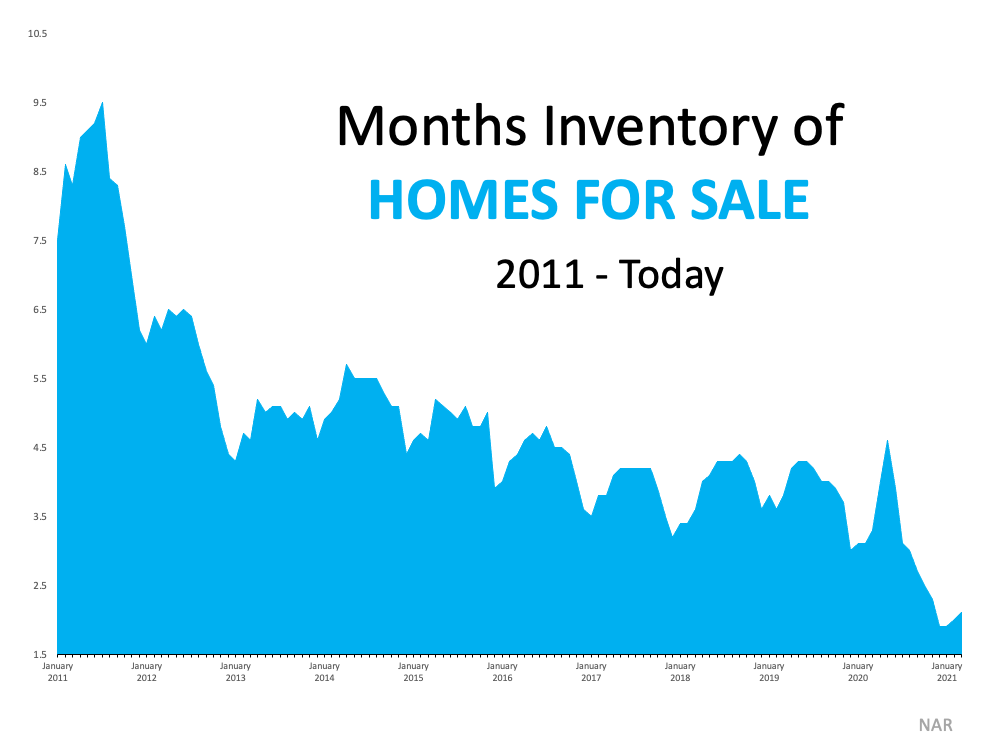

Here, you can see the equity gains by state: Equity Provides Homeowners with Flexibility In addition to being a critical tool in building wealth, a homeowner’s equity also provides significant flexibility. When you sell your house, the accumulated equity comes back to you in the sale. Recent increases in home equity coupled with record-low mortgage rates mean it could be the perfect time for homeowners looking to make a move. Mark Fleming, Chief Economist at First American, notes: “Existing homeowners today are sitting on record amounts of equity. As homeowners gain equity in their homes, the temptation grows to list their current home for sale and use the equity to purchase a larger or more attractive home.” Increasing equity also helps families facing challenges brought on by the pandemic. Frank Martell, President and CEO of CoreLogic, explains in the recent Homeowner Equity Insights Report: “Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic. These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who’ve experienced years of price appreciation.” Bottom Line Home equity has always been a powerful wealth-building tool, and homeowners continue to see their financial stability increase. If you are looking to BUY or SELL in Las Vegas, let’s connect today so you can better understand how much equity you have in your current home or if you’re ready to take the next step in building your savings as a homeowner.  We’re in the ultimate sellers’ market in Las Vegas right now. If you’re a homeowner thinking about selling, you have a huge advantage in today’s housing market. High buyer demand paired with very few houses for sale makes this the optimal time to sell for those who are ready to do so. Whatever the move you want to make looks like, here’s an overview of what’s creating the prime opportunity to sell this summer. High Buyer Demand Demand is strong, and buyers are actively searching for homes to purchase. In the Realtors Confidence Index Survey published monthly by the National Association of Realtors (NAR), buyer traffic is considered “very strong” in almost every state. Homebuyers aren’t just great in number right now – they’re also determined to find their dream home. NAR shows the average home for sale today receives five offers from hopeful buyers. These increasingly frequent bidding wars can drive up the price of your house, which is why high demand from competitive homebuyers is such a win for this summer’s sellers. Low Inventory of Houses for Sale Purchaser demand is so high, the market is running out of available homes for sale. Danielle Hale, Chief Economist at realtor.com, explains: “For most sellers listing sooner rather than later could really pay off with less competition from other sellers and potentially a higher sales price… They’ll also avoid some big unknowns lurking later in the year, namely another possible surge in COVID cases, raising interest rates and the potential for more sellers to enter the market.” NAR also reveals that unsold inventory sits at a 2.4-months’ supply at the current sales pace. This is far lower than the historical norm of a 6.0-months’ supply. Homes are essentially selling as fast as they’re hitting the market. Below is a graph of the existing inventory of single-family homes for sale: At the same time, homebuilders are increasing construction this year, but they can’t keep up with the growing demand. While reporting on the inventory of newly constructed homes, the U.S. Census Bureau notes: “The seasonally‐adjusted estimate of new houses for sale at the end of April was 316,000. This represents a supply of 4.4 months at the current sales rate.” What Does This Mean for You? If you’re thinking of putting your house on the market, don’t wait. A seller will always negotiate the best deal when demand is high and supply is low. That’s exactly what’s happening in the real estate market today. Bottom Line As vaccine rollouts progress and we continue to see the economy recover, more houses will come to the market. Don’t wait for the competition in your neighborhood to increase. If you’re ready to make a move, now is the time to sell. Contact me today to get your house listed at this optimal moment in time. The major challenge in the housing market in Las Vegas is that there are more buyers looking to purchase than there are homes available to buy. Simply put, supply can’t keep up with demand. A normal market has a 6-month supply of homes for sale. Anything over that indicates it’s a buyers’ market, but an inventory level below that threshold means we’re in a sellers’ market. Today’s inventory level sits far below the norm.

According to the Existing Home Sales Report from the National Association of Realtors (NAR): “Total housing inventory at the end of April amounted to 1.16 million units, up 10.5% from March’s inventory and down 20.5% from one year ago (1.46 million). Unsold inventory sits at a 2.4-month supply at the current sales pace, slightly up from March’s 2.1-month supply and down from the 4.0-month supply recorded in April 2020. These numbers continue to represent near-record lows.” Basically, while we are seeing some improvement, we’re still at near-record lows for housing inventory (as shown in the graph below). Here’s why. Since the pandemic began, sellers have been cautious when it comes to putting their homes on the market. At the same time that fewer people are listing their homes, more and more people are trying to buy them thanks to today’s low mortgage rates. The influx of buyers aiming to capitalize on those rates are purchasing this limited supply of homes as quickly as they’re coming to market. This inventory shortage doesn’t just apply to existing homes that are already built. When it comes to new construction, builders are trying to do their part to bring more newly built homes into the market. However, due to challenges with things like lumber supply, they’re also not able to keep up with demand. In their Monthly New Residential Sales report, the United States Census Bureau states: “The seasonally‐adjusted estimate of new houses for sale at the end of April was 316,000. This represents a supply of 4.4 months at the current sales rate.” Sam Khater, Chief Economist at Freddie Mac, elaborates: “In the span of five decades, entry level construction fell from 418,000 units per year in the late 1970s to 65,000 in 2020. While in 2020 only 65,000 entry-level homes were completed, there were 2.38 million first-time homebuyers that purchased homes. Not all renters looking to purchase their first home were in the market for entry-level homes, however, the large disparity illustrates the significant and rapidly widening gap between entry-level supply and demand.” Despite today’s low inventory, there is hope on the horizon. Regarding existing home sales, Sabrina Speianu, Senior Economic Research Analyst at realtor.com, explains: “In May, newly listed homes grew by 5.4% on a year-over-year basis compared to the earlier days of the COVID-19 pandemic last year… In May, the share of newly listed homes compared to active daily inventory hit a historical high of 44.4%, 17.3 percentage points higher than last year and 15.1 percentage points above typical levels seen in 2017 to 2019. This is a reflection of quickly selling homes and, for buyers, it means that while they can expect fresh new listings every week, they will have to be prepared to move quickly on desirable homes.” As for newly built homes, builders are also confident about what’s ahead for housing inventory. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), shares: “Builder confidence in the market remains strong due to a lack of resale inventory, low mortgage interest rates, and a growing demographic of prospective home buyers.” Things are starting to look up for residential real estate inventory. As the country continues to reopen, more houses are likely to be listed for sale. However, as long as buyer demand remains high, it will take time for the balance between supply and demand to truly neutralize. Bottom Line Although it may be challenging to find a house to buy in today’s market, there is hope on the horizon. Contact us to talk about your home search so we can find your dream home this summer! This year, Americans are moving for a variety of reasons. The health crisis has truly reshaped our lifestyles and our needs. Spending so much more time in our current homes has driven many people to reconsider what homeownership means and what they find most valuable in their living spaces.

According to the 2020 Annual National Movers Study: “For customers who cited COVID-19 as an influence on their move in 2020, the top reasons associated with COVID-19 were concerns for personal and family health and wellbeing (60%); desires to be closer to family (59%); 57% moved due to changes in employment status or work arrangement (including the ability to work remotely); and 53% desired a lifestyle change or improvement of quality of life.” With a new perspective on homeownership, here are some of the reasons people are reconsidering where they live and making moves right now. 1. Working from Home Remote work became the new norm, and for some, it’s persisting longer than initially expected. Many in the workforce today are discovering they don’t need to live so close to the office anymore and they can get more for their money if they move a little further outside the city limits. Apartment List notes: “The COVID pandemic has sparked a rebound in residential migration: survey data suggest that 16 percent of American workers moved between April 2020 and April 2021, up from 14 percent in 2019 and the first increase in migration in over a decade… One of the major drivers in this trend is remote work, which expanded greatly in response to COVID and will remain prevalent even after the pandemic wanes. No longer tethered to a physical job site, remote workers were 53 percent more likely to move this past year than on-site workers.” If you’ve tried to convert your guest room or your dining room into a home office with minimal success, it may be time to find a larger home. The reality is, your current house may not be optimally designed for this kind of space, making remote work very challenging. 2. Room for Fitness & Activities Staying healthy and active is a top priority for many Americans, and dreams of having space for a home gym are growing stronger. A recent survey of 4,538 active adults from 122 countries noted the three fastest-growing fitness trends amongst active adults:

3. Outdoor Space Better Homes & Gardens recently released the outdoor living trends for this year, and three of them are:

Bottom Line If you’re clamoring for more room to accommodate your changing needs, making a move may be your best bet, especially while you can take advantage of today’s low mortgage rates. It’s a great time to get more home for your money, just when you need it most. When buying a home, it’s important to have a budget and make sure you plan ahead for certain homebuying expenses. Saving for a down payment is the main cost that comes to mind for many, but budgeting for the closing costs required to get a mortgage is just as important.

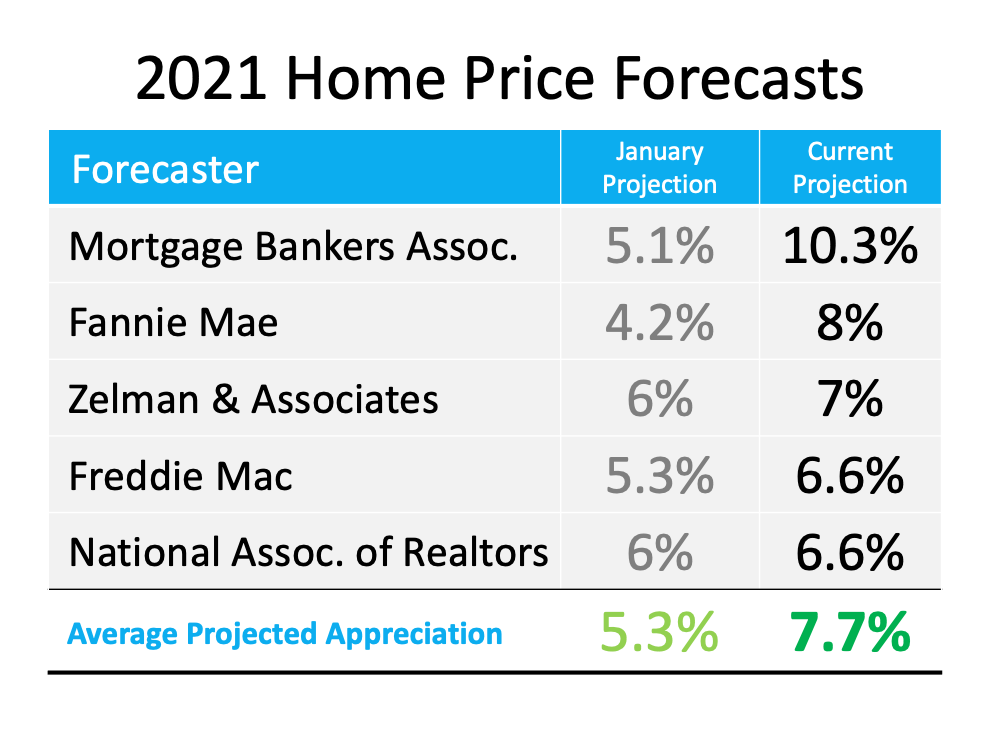

What Are Closing Costs? According to Trulia: “When you close on a home, a number of fees are due. They typically range from 2% to 5% of the total cost of the home, and can include title insurance, origination fees, underwriting fees, document preparation fees, and more.” For example, for someone buying a $300,000 home, they could potentially have between $6,000 and $15,000 in closing fees. If you’re in the market for a home above this price range, your closing costs could be greater. Different Lender's Charge Different Fees! Yes, different lenders charge different fees! Some lenders charge Origination Fees. Some lenders charge Processing Fees. Some offer higher interest rates. Some lenders will offer a little bit higher of an interest rate, but give you a credit to pay for some of your closing costs. These are all considerations when deciding what lender to use. It's important to know you have options! I recommend checking with a couple lenders to make sure you are choosing the best option for you and your needs. It is very important that you trust and feel comfortable with your lender. Buying a home is one of the most important purchases in your life. It's important to have people you trust on your side! Trulia gives more great advice, explaining: “There will be lots of paperwork in front of you on closing day, and not enough time to read them all. Work closely with your real estate agent, lender, and attorney, if you have one, to get all the documents you need ahead of time. The most important thing to read is the closing disclosure, which shows your loan terms, final closing costs, and any outstanding fees. You’ll get this form about three days before closing since, once you (the borrower) sign it, there’s a three-day waiting period before you can sign the mortgage loan docs. If you have any questions about the numbers or what any of the mortgage terms mean, this is the time to ask—your real estate agent is a great resource for getting you all the answers you need.” Bottom Line As home prices are rising and more buyers are finding themselves competing in bidding wars, it’s more important than ever to make sure your plan includes budgeting for closing costs. Check out your options! A good lender will run different scenarios for you. It's important to know what to expect in regards to payment, interest rates, downpayment, and closing costs before moving forward with purchasing a home. That's the first step! If you would like to discuss what you need to do to get prepared to buy a home in the Las Vegas area, reach out to me. I'd love to talk! Well, the forecaster's GOT IT WRONG! At the beginning of the year, industry forecasts called for home price appreciation to slow to about half of the double-digit increase we saw last year. The thinking was that inventory would increase from record-low levels and put an end to the bidding wars that have driven home prices up over the past twelve months. However, that increase in inventory has yet to materialize. We are at an all time low of inventory in the Las Vegas area! The National Association of Realtors (NAR) reports that there are currently 410,000 fewer single-family homes available for sale than there were at this time last year. This has forced those who made appreciation forecasts this past January to amend those projections. The Mortgage Bankers Association, Fannie Mae, Freddie Mac, the National Association of Realtors, and Zelman & Associates have all adjusted their numbers upward after reviewing first quarter housing data. Here are their original forecasts and their newly updated projections: Even with the increases, the updated projections still don’t reach the above 10% appreciation levels of 2020. However, a jump in the average projection from 5.3% to 7.7% after just one quarter is substantial. Demand will remain strong, so future appreciation will be determined by how quickly listing inventory makes its way to the market.

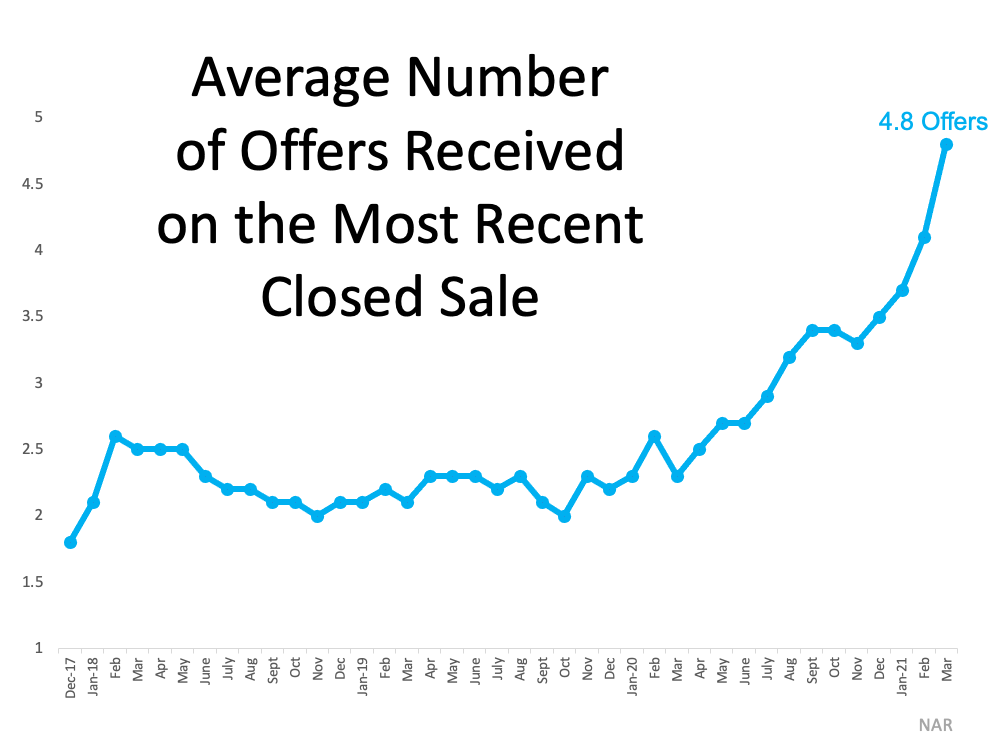

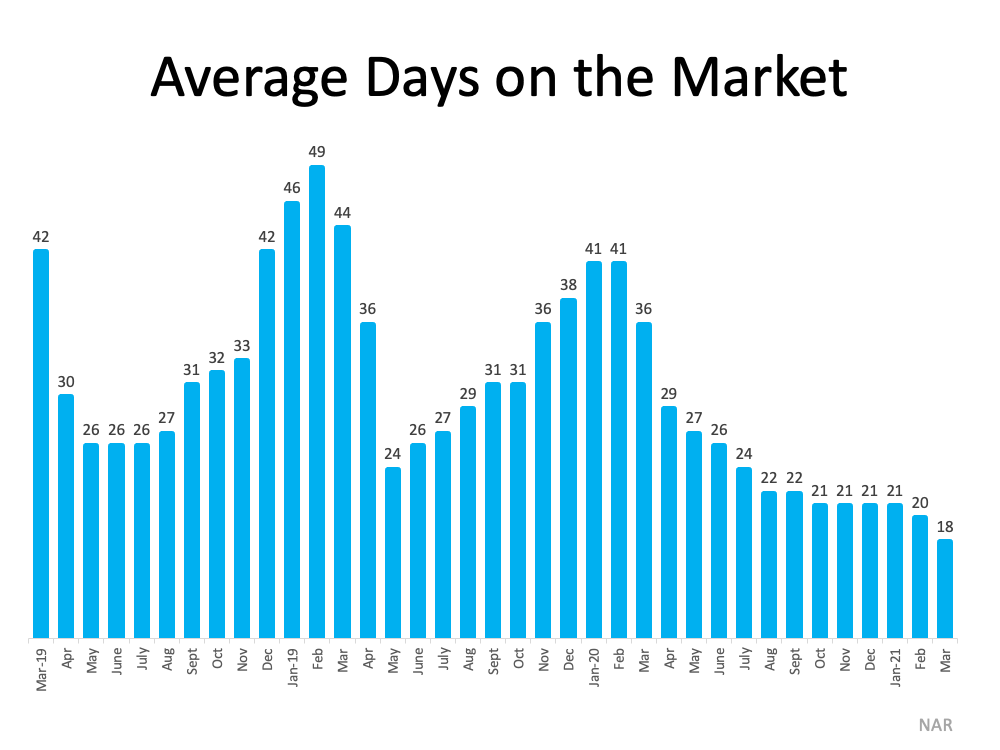

Bottom Line Entering 2021, there was some speculation that we might see price appreciation slow dramatically this year. Today, experts believe that won’t be the case. They forecast that home values will remain strong throughout the year. 2021 is the YEAR OF THE SELLER in Las Vegas! If you’re a homeowner in the Las Vegas area thinking of moving to better suit your changing needs, now is the perfect time to do so. Low mortgage rates are in your favor when you’re ready to purchase your dream home, and high buyer demand may give you the leverage you need to negotiate the best contract terms on the sale of your house. Here’s a look at what’s driving this sellers’ advantage and why there’s so much opportunity for homeowners who are ready to move this season. 1. Historically Low Inventory The National Association of Realtors (NAR) explains: “Total housing inventory at the end of March amounted to 1.07 million units, up 3.9% from February’s inventory . . . Unsold inventory sits at a 2.1-month supply at the current sales pace, marginally up from February’s 2.0-month supply and down from the 3.3-month supply recorded in March 2020.” Even with a slight rise in the number of houses for sale this spring, inventory remains near an all-time low (See graph below): High buyer interest is creating a major imbalance between supply and demand, but as the small uptick in inventory shows, sellers are beginning to reenter the market. Selling your house now enables you to take advantage of buyer demand and get the most attention for your house – before more listings come to the market later this year. 2. Frequent Bidding Wars As a result of the supply and demand imbalance, homebuyers are entering bidding wars at an accelerating rate. NAR reports the average number of bids received on the most recently closed sales is 4.8 offers. This number has doubled since the first quarter of 2020 (See graph below): As buyers face increasingly tough competition while searching for homes to purchase, they’re more likely to be flexible and generous in their negotiations. This gives a seller the opportunity to choose the best buyer for their needs and be selective about things like time to close, contingencies, renovations, and more. Working with your trusted agent is the best way to determine how to navigate the negotiation process when selling your house. 3. Days on the Market In today’s market, sellers aren’t waiting very long to find a buyer for their house, either. NAR reports: “Properties typically remained on the market for 18 days in March, down from 20 days in February and from 29 days in March 2020. 83% of the homes sold in March 2021 were on the market for less than a month.” (See graph below): NAR Chief Economist Lawrence Yun explains:

“The sales for March would have been measurably higher, had there been more inventory…Days-on-market are swift, multiple offers are prevalent, and buyer confidence is rising.” Bottom Line If you’re thinking about moving, these three graphs clearly show that it’s a great time to sell your house. Let’s connect today so you can learn more about the opportunities in our local area.  Homebuyers are flooding the housing market right now to take advantage of record-low mortgage rates. Many have a sense of urgency to find a home soon since experts forecast a steady rise in both rates and home prices this year and next. As a result, buyer demand greatly outweighs the current housing supply. Here’s how the shortage of houses for sale sets yours up to be the oasis in an inventory desert. According to the National Association of Realtors (NAR), today’s housing inventory sits atan incredibly low 2.1-month supply, far below the 6-month mark for a neutral market. Inventory of single-family homes a year ago was already very low, and as you can see in the graph below, this year’s levels are even lower:an incredibly low 2.1-month supply, far below the 6-month mark for a neutral market. Inventory of single-family homes a year ago was already very low, and as you can see in the graph below, this year’s levels are even lower: Due to these market conditions, today’s buyers frequently enter fierce bidding wars while trying to purchase a home. This in turn drives up home prices and gives sellers incredible leverage in the negotiation process, two big wins if you’re going to sell your house this year. Bottom Line In such a hot market, it can feel as though the supply of homes has virtually dried up, leaving buyers to wander in an inventory desert. That’s why there’s never been a better time to sell. To a parched buyer needing to secure a home as soon as possible, your house could be a true oasis. |

About KellyKelly Albright is Broker/Owner of Vision Realty Group and has been in Real Estate for 17 years. She has closed over 700 homes in Las Vegas, North Las Vegas, and Henderson. Archives

August 2022

Categories |

Copyright ©2017

Web Design by Lisa Smith, GEEK GIRLS IN VEGAS

Web Design by Lisa Smith, GEEK GIRLS IN VEGAS

RSS Feed

RSS Feed