Our Blog

|

When buying a home, it’s important to have a budget and make sure you plan ahead for certain homebuying expenses. Saving for a down payment is the main cost that comes to mind for many, but budgeting for the closing costs required to get a mortgage is just as important.

What Are Closing Costs? According to Trulia: “When you close on a home, a number of fees are due. They typically range from 2% to 5% of the total cost of the home, and can include title insurance, origination fees, underwriting fees, document preparation fees, and more.” For example, for someone buying a $300,000 home, they could potentially have between $6,000 and $15,000 in closing fees. If you’re in the market for a home above this price range, your closing costs could be greater. Different Lender's Charge Different Fees! Yes, different lenders charge different fees! Some lenders charge Origination Fees. Some lenders charge Processing Fees. Some offer higher interest rates. Some lenders will offer a little bit higher of an interest rate, but give you a credit to pay for some of your closing costs. These are all considerations when deciding what lender to use. It's important to know you have options! I recommend checking with a couple lenders to make sure you are choosing the best option for you and your needs. It is very important that you trust and feel comfortable with your lender. Buying a home is one of the most important purchases in your life. It's important to have people you trust on your side! Trulia gives more great advice, explaining: “There will be lots of paperwork in front of you on closing day, and not enough time to read them all. Work closely with your real estate agent, lender, and attorney, if you have one, to get all the documents you need ahead of time. The most important thing to read is the closing disclosure, which shows your loan terms, final closing costs, and any outstanding fees. You’ll get this form about three days before closing since, once you (the borrower) sign it, there’s a three-day waiting period before you can sign the mortgage loan docs. If you have any questions about the numbers or what any of the mortgage terms mean, this is the time to ask—your real estate agent is a great resource for getting you all the answers you need.” Bottom Line As home prices are rising and more buyers are finding themselves competing in bidding wars, it’s more important than ever to make sure your plan includes budgeting for closing costs. Check out your options! A good lender will run different scenarios for you. It's important to know what to expect in regards to payment, interest rates, downpayment, and closing costs before moving forward with purchasing a home. That's the first step! If you would like to discuss what you need to do to get prepared to buy a home in the Las Vegas area, reach out to me. I'd love to talk!

0 Comments

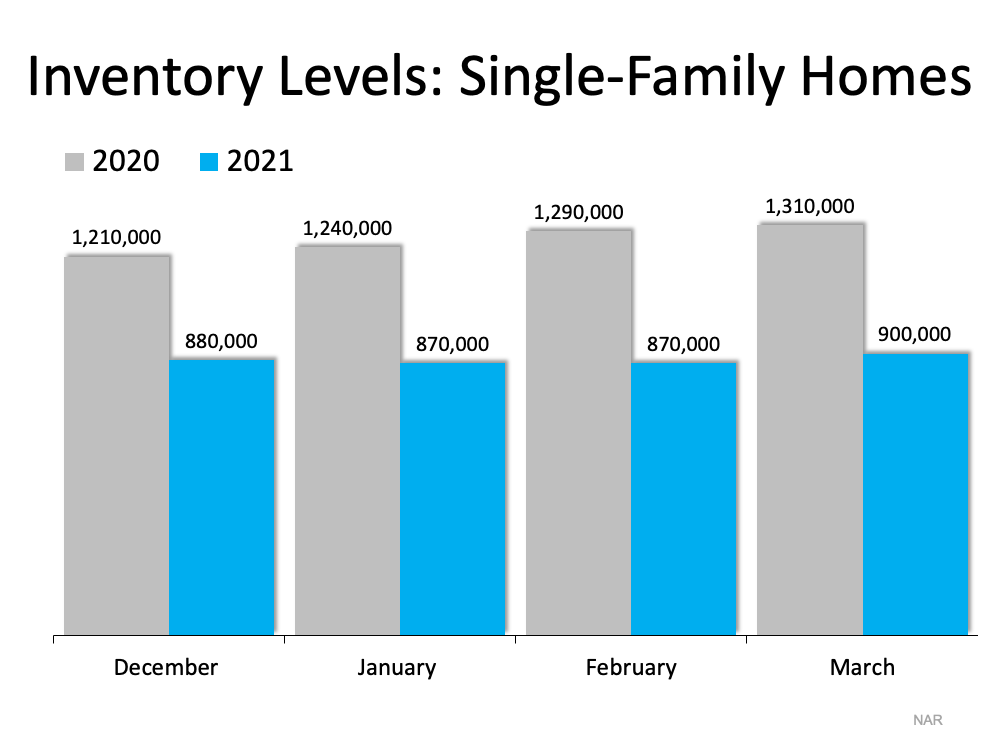

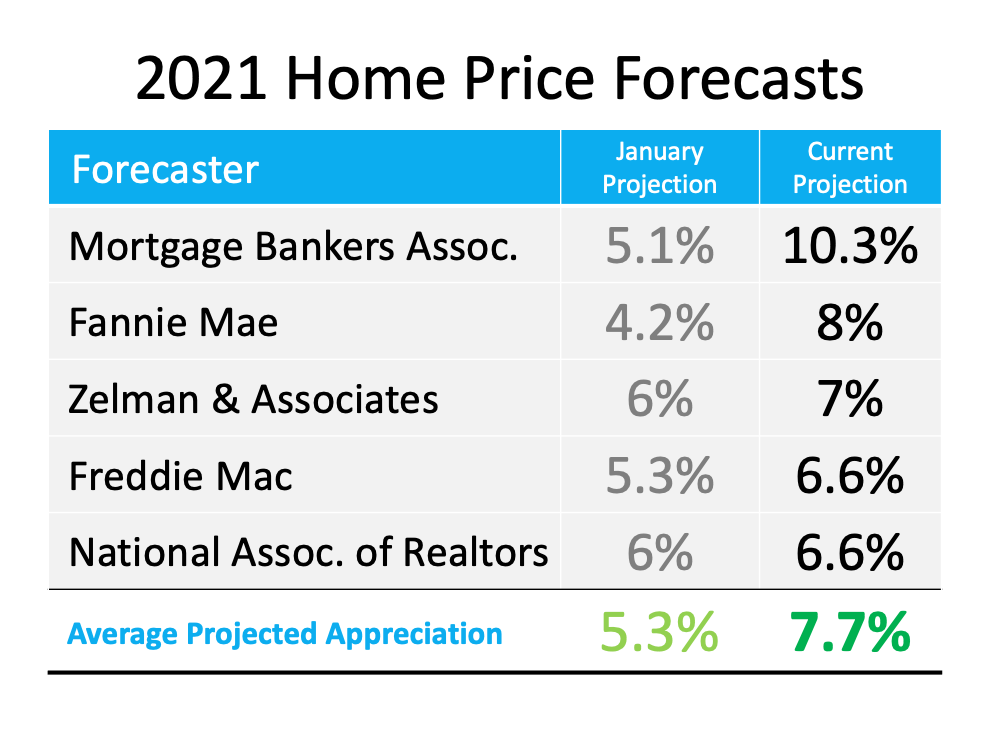

Well, the forecaster's GOT IT WRONG! At the beginning of the year, industry forecasts called for home price appreciation to slow to about half of the double-digit increase we saw last year. The thinking was that inventory would increase from record-low levels and put an end to the bidding wars that have driven home prices up over the past twelve months. However, that increase in inventory has yet to materialize. We are at an all time low of inventory in the Las Vegas area! The National Association of Realtors (NAR) reports that there are currently 410,000 fewer single-family homes available for sale than there were at this time last year. This has forced those who made appreciation forecasts this past January to amend those projections. The Mortgage Bankers Association, Fannie Mae, Freddie Mac, the National Association of Realtors, and Zelman & Associates have all adjusted their numbers upward after reviewing first quarter housing data. Here are their original forecasts and their newly updated projections: Even with the increases, the updated projections still don’t reach the above 10% appreciation levels of 2020. However, a jump in the average projection from 5.3% to 7.7% after just one quarter is substantial. Demand will remain strong, so future appreciation will be determined by how quickly listing inventory makes its way to the market.

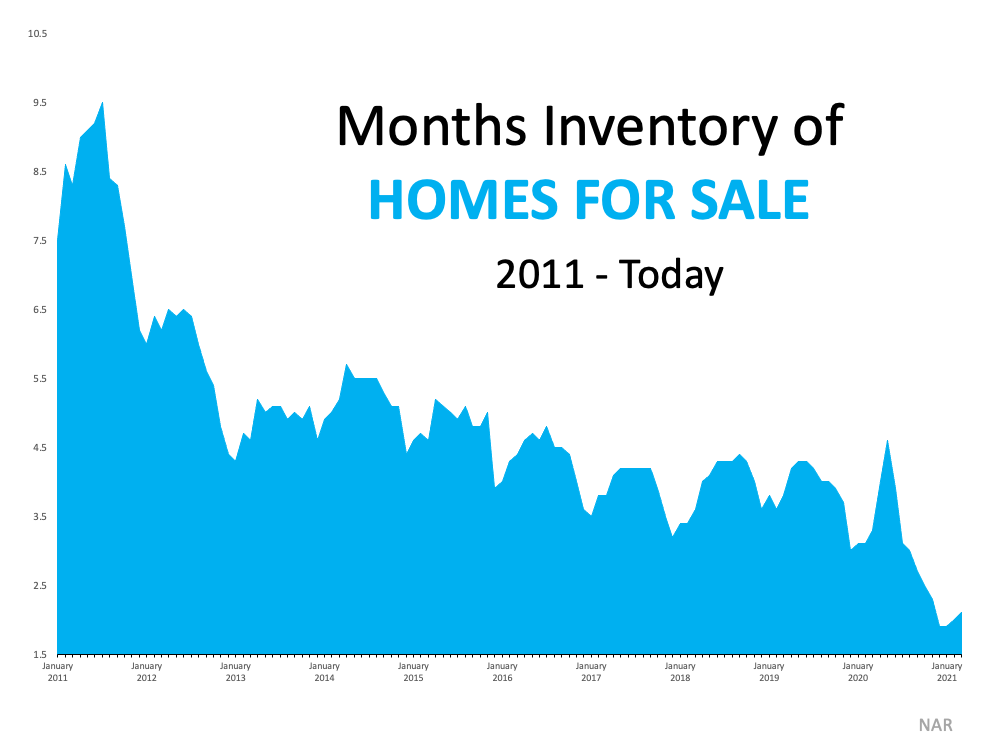

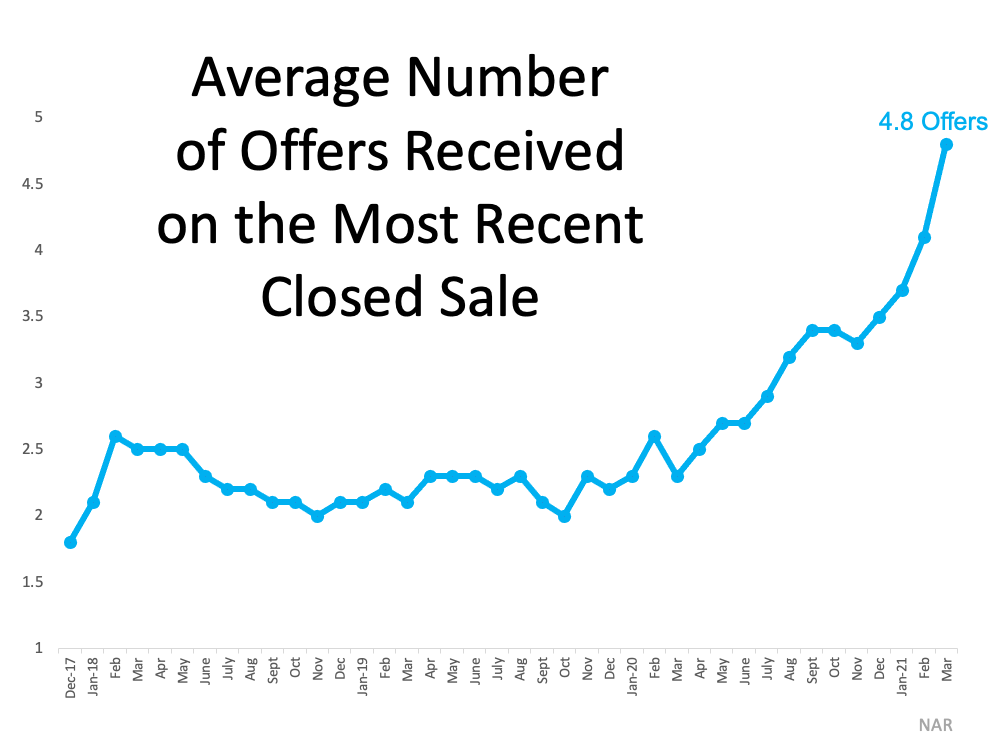

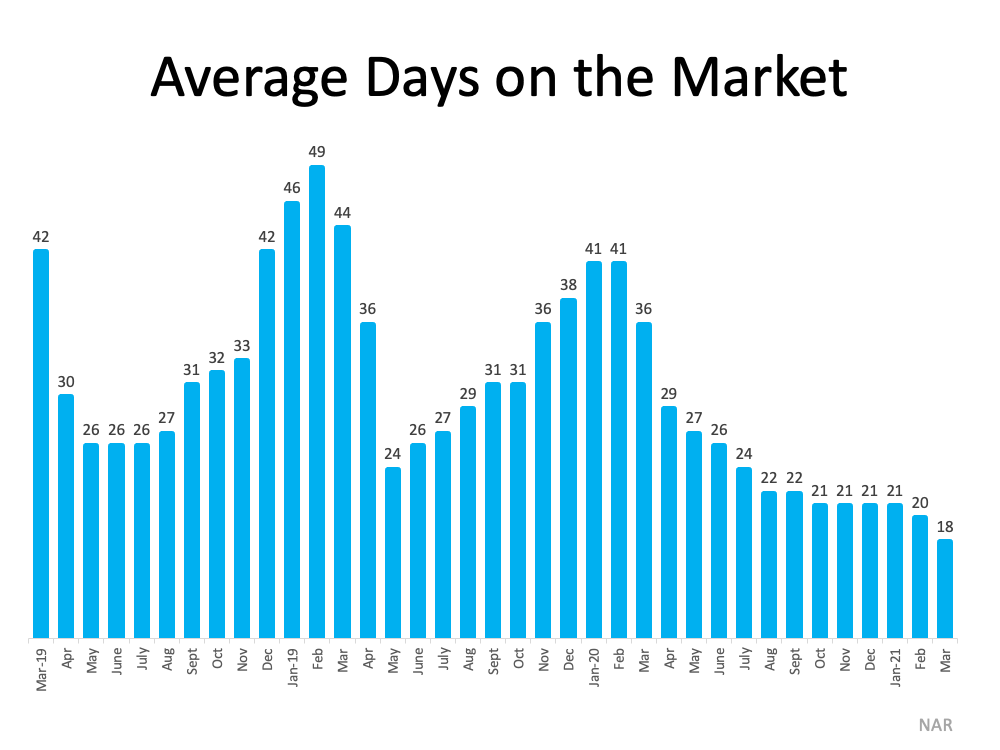

Bottom Line Entering 2021, there was some speculation that we might see price appreciation slow dramatically this year. Today, experts believe that won’t be the case. They forecast that home values will remain strong throughout the year. 2021 is the YEAR OF THE SELLER in Las Vegas! If you’re a homeowner in the Las Vegas area thinking of moving to better suit your changing needs, now is the perfect time to do so. Low mortgage rates are in your favor when you’re ready to purchase your dream home, and high buyer demand may give you the leverage you need to negotiate the best contract terms on the sale of your house. Here’s a look at what’s driving this sellers’ advantage and why there’s so much opportunity for homeowners who are ready to move this season. 1. Historically Low Inventory The National Association of Realtors (NAR) explains: “Total housing inventory at the end of March amounted to 1.07 million units, up 3.9% from February’s inventory . . . Unsold inventory sits at a 2.1-month supply at the current sales pace, marginally up from February’s 2.0-month supply and down from the 3.3-month supply recorded in March 2020.” Even with a slight rise in the number of houses for sale this spring, inventory remains near an all-time low (See graph below): High buyer interest is creating a major imbalance between supply and demand, but as the small uptick in inventory shows, sellers are beginning to reenter the market. Selling your house now enables you to take advantage of buyer demand and get the most attention for your house – before more listings come to the market later this year. 2. Frequent Bidding Wars As a result of the supply and demand imbalance, homebuyers are entering bidding wars at an accelerating rate. NAR reports the average number of bids received on the most recently closed sales is 4.8 offers. This number has doubled since the first quarter of 2020 (See graph below): As buyers face increasingly tough competition while searching for homes to purchase, they’re more likely to be flexible and generous in their negotiations. This gives a seller the opportunity to choose the best buyer for their needs and be selective about things like time to close, contingencies, renovations, and more. Working with your trusted agent is the best way to determine how to navigate the negotiation process when selling your house. 3. Days on the Market In today’s market, sellers aren’t waiting very long to find a buyer for their house, either. NAR reports: “Properties typically remained on the market for 18 days in March, down from 20 days in February and from 29 days in March 2020. 83% of the homes sold in March 2021 were on the market for less than a month.” (See graph below): NAR Chief Economist Lawrence Yun explains:

“The sales for March would have been measurably higher, had there been more inventory…Days-on-market are swift, multiple offers are prevalent, and buyer confidence is rising.” Bottom Line If you’re thinking about moving, these three graphs clearly show that it’s a great time to sell your house. Let’s connect today so you can learn more about the opportunities in our local area.  Homebuyers are flooding the housing market right now to take advantage of record-low mortgage rates. Many have a sense of urgency to find a home soon since experts forecast a steady rise in both rates and home prices this year and next. As a result, buyer demand greatly outweighs the current housing supply. Here’s how the shortage of houses for sale sets yours up to be the oasis in an inventory desert. According to the National Association of Realtors (NAR), today’s housing inventory sits atan incredibly low 2.1-month supply, far below the 6-month mark for a neutral market. Inventory of single-family homes a year ago was already very low, and as you can see in the graph below, this year’s levels are even lower:an incredibly low 2.1-month supply, far below the 6-month mark for a neutral market. Inventory of single-family homes a year ago was already very low, and as you can see in the graph below, this year’s levels are even lower: Due to these market conditions, today’s buyers frequently enter fierce bidding wars while trying to purchase a home. This in turn drives up home prices and gives sellers incredible leverage in the negotiation process, two big wins if you’re going to sell your house this year. Bottom Line In such a hot market, it can feel as though the supply of homes has virtually dried up, leaving buyers to wander in an inventory desert. That’s why there’s never been a better time to sell. To a parched buyer needing to secure a home as soon as possible, your house could be a true oasis. Homeownership is a foundational part of the American Dream. As we look back on more than a year of sheltering in our homes, having a place of our own is more important than ever. While financial benefits are always a key aspect of homeownership, today, homeowners rank the nonfinancial and personal benefits with even higher value.

Recently, two national surveys revealed the reasons homeownership is such an important part of life. The top three personal benefits of homeownership noted by respondents in Unison’s 2021 report on The State of the American Homeowner are:

These sentiments were supported by the most recent National Housing Surveyfrom Fannie Mae, which also shows that the top three reasons Americans value homeownership have nothing to do with money. Those surveyed were given a list of feelings and accomplishments that are associated with or impacted by where we live. They were then asked, “To achieve this, are you better off owning or better off renting?” Here are the top three points from the list that respondents said homeownership could help them achieve:

Other nonfinancial advantages of homeownership revealed by the survey include feeling engaged in a community, having flexibility in future decisions, and experiencing less stress. Bottom Line Financial and nonfinancial benefits are a key component to the value of homeownership, but the nonfinancial side is most valued after a year full of pandemic-driven challenges. Let’s connect today if you’re ready to take the first steps toward becoming a homeowner. I've been getting a ton of questions regarding what the market is going to do here in Las Vegas. I don't have a crystal ball, but here is some research concerning whether or not we are in a housing bubble.

It’s very clear that consumers are concerned about how quickly home values are rising. Many people fear the speed of appreciation may lead to a crash in prices later this year. In fact, Google reports that the search for “When is the housing market going to crash?” has actually spiked 2450% over the past month. In addition, Jim Dalrymple II of Inman News notes: “One of the most noteworthy things that came up in Inman’s conversations with agents was that every single one said they’ve had conversations with clients about whether or not the market is heading into a bubble.” To alleviate some of these concerns, let’s look at what several financial analysts are saying about the current residential real estate market. Within the last thirty days, four of the major financial services giants came to the same conclusion: the housing market is strong, and price appreciation will continue. Here are their statements on the issue: Goldman Sachs’ Research Note on Housing: “Strong demand for housing looks sustainable. Even before the pandemic, demographic tailwinds and historically-low mortgage rates had pushed demand to high levels. … consumer surveys indicate that household buying intentions are now the highest in 20 years. … As a result, the model projects double-digit price gains both this year and next.” Joe Seydl, Senior Markets Economist, J.P.Morgan: “Homebuyers—interest rates are still historically low, though they are inching up. Housing prices have spiked during the last six-to-nine months, but we don’t expect them to fall soon, and we believe they are more likely to keep rising. If you are looking to purchase a new home, conditions now may be better than 12 months hence.” Morgan Stanley, Thoughts on the Market Podcast: “Unlike 15 years ago, the euphoria in today’s home prices comes down to the simple logic of supply and demand. And we at Morgan Stanley conclude that this time the sector is on a sustainably, sturdy foundation . . . . This robust demand and highly challenged supply, along with tight mortgage lending standards, may continue to bode well for home prices. Higher interest rates and post pandemic moves could likely slow the pace of appreciation, but the upward trajectory remains very much on course.” Merrill Lynch’s Capital Market Outlook: “There are reasons to believe that this is likely to be an unusually long and strong housing expansion. Demand is very strong because the biggest demographic cohort in history is moving through the household-formation and peak home-buying stages of its life cycle. Coronavirus-related preference changes have also sharply boosted home buying demand. At the same time, supply is unusually tight, with available homes for sale at record-low levels. Double-digit price gains are rationing the supply.” Bottom Line: If you’re concerned about making the decision to buy or sell right now, give a call or shoot us a text. We would be happy to discuss what real estate move may be best for you. The question many homebuyers in Las Vegas are facing this year is, “Why is it so hard to find a house?” We’re in the ultimate sellers’ market here, which means real estate is ultra-competitive for buyers right now. The National Association of Realtors (NAR) notes homes are getting an average of 4.8 offers per sale, and that number keeps rising. Why? It’s because there are so few houses for sale.

Low inventory in the housing market isn’t new, but it’s becoming more challenging to navigate. Danielle Hale, Chief Economist at realtor.com, explains: “The housing market is still relatively under supplied, and buyers can’t buy what’s not for sale. Relative to what we saw in 2017 to 2019, March 2021 was still roughly 117,000 new listings lower, adding to the pre-existing early-year gap of more than 200,000 fresh listings that would typically have come to market in January or February. Despite this week’s gain from a year ago, we’re 19 percent below the new seller activity that we saw in the same week in 2019.” While many homeowners paused their plans to sell during the height of the pandemic, this isn’t the main cause of today’s huge gap between supply and demand. Sam Khater, Vice President and Chief Economist at Freddie Mac, Economic Housing and Research Division, shares: “The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes . . . That decline has resulted in the decrease in supply of entry-level single-family homes or, ’starter homes.’” The number of newly built homes is disproportionately lower than the rate of household formation, which, according to the U.S. Census Bureau, has continued to increase. Khater also explains: “Even before the COVID-19 pandemic and current recession, the housing market was facing a substantial supply shortage and that deficit has grown. In 2018, we estimated that there was a housing supply shortage of approximately 2.5 million units, meaning that the U.S. economy was about 2.5 million units below what was needed to match long-term demand. Using the same methodology, we estimate that the housing shortage increased to 3.8 million units by the end of 2020. A continued increase in a housing shortage is extremely unusual; typically in a recession, housing demand declines and supply rises, causing inventory to rise above the long-term trend.” To catch up to current demand, Freddie Mac estimates we need to build almost four million homes. The good news is builders are working hard to get us there. The U.S. Census Bureau also states: “Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,766,000. This is 2.7 percent (±1.7 percent) above the revised February rate of 1,720,000 . . . Privately-owned housing starts in March were at a seasonally adjusted annual rate of 1,739,000. This is 19.4 percent (±13.7 percent) above the revised February estimate of 1,457,000. . . .” What does this mean? Lawrence Yun, Chief Economist at NAR, clarifies: “The March figure of 1.74 million housing starts is the highest in 14 years. Both single-family units and multifamily units ramped up. After 13 straight years of underproduction – the chief cause for today’s inventory shortage – this construction boom needs to last for at least three years to make up for the part shortfall. As trade-up buyers purchase newly constructed homes, their prior homes will show up in MLSs, and hence, more choices for consumers. Housing starts to housing completion could be 4 to 8 months, so be patient with the improvement to inventory. In the meantime, construction workers deserve cheers.” Bottom Line: If you’re planning to buy this year, the key to success will be patience, given today’s low inventory environment. I truly believe that Buyer's end up with the houses they supposed to and that everything falls into place when the right house comes along. It's hard to not get discouraged, but The Albright will stick through it with you to make sure you get the house that's meant to be! The housing market in Las Vegas keeps sailing along. The only headwind that could take it off course is the lack of inventory for sale. The National Association of Realtors (NAR) reports that there were 410,000 fewer single-family homes for sale this March than in March of 2020. The key to continued success in the residential housing market is for more listings to come on the market. However, many homeowners are concerned that selling their homes could be challenging for several reasons.

Recently, Homes.com released the findings of a survey that identified these concerns, as well as what it will take for homeowners to feel comfortable selling their houses. Here are the four major homeowner concerns and a quick explanation of what’s actually happening in the housing market today. 1. Homeowners don’t know if they’ll be able to secure their next home before selling. In negotiations, leverage is the power that one side may have to influence the other side while moving closer to their negotiating position. A party’s leverage is based on the ability to award benefits or eliminate costs on the other side. In today’s market, buyers have compelling reasons to purchase a home now:

Most already realize this leverage enables the homeowner to sell at a good price. However, this leverage may also be used to negotiate time to find their next home. The homeowner could sell their home to the buyer at today’s price, which will enable the purchaser to take advantage of current mortgage rates. In return, the buyer might lease the house back to the seller for a pre-determined length of time while the seller finds a new home or has one built. This gives the buyer what they want while also giving the seller what they need. It’s a true win-win negotiation. 2. Homeowners don’t know if their current home will sell for the asking price or top market price. This is the perfect time to maximize profits while selling a house. NAR just released a study showing that bidding wars are at an all-time high. The study reveals that when comparing the first quarter of last year to the first quarter of this year, the number of offers on homes for sale doubled from an average of 2.4 to 4.8 offers. Whenever there’s a bidding war, the price of the item for sale escalates. Bloomberg recently reported: “For the first time ever, the average U.S. home is selling for above its list price.” If a seller is looking for a top-dollar sale, there’s no better time to sell than right now. 3. Homeowners don’t know if they will get an offer without their home requiring work or updates. Again, leverage is the greatest strength a seller has in this market. Due to the lack of homes for sale, many buyers are more willing to take on home improvement projects themselves in order to get the home they’re after. A recent post on whether or not to renovate before selling notes: “It may be wise to let future homeowners remodel the bathroom or the kitchen to make design decisions that are best for their specific taste and lifestyle. As a seller, your dollars and time might be better spent working on small cosmetic updates, like refreshing some paint and power washing the exterior. Instead of over-investing in your home with upgrades that the buyers may change anyway, work with a real estate professional to determine the key projects that will maximize your listing, without overdoing it.” If a seller is worried about doing work or updates on their home, they must realize that today’s historically low inventory likely renders these projects less critical to the sale of the house. 4. Homeowners don’t know if they can have a quick closing process. When speed is important, there are two points sellers should look at:

In the latest Existing Home Sales Report, NAR explains: “Properties typically remained on the market for 18 days in March, down from 20 days in February and from 29 days in March 2020. Eighty-three percent of the homes sold in March 2021 were on the market for less than a month.” Eighteen days is fast, and it’s a new record. Here are the days the average house is on the market in each state:Regarding the time it will take to close the transaction, all-cash sales accounted for 23% of all home purchase transactions in March. All-cash sales can usually be closed in thirty days. If a mortgage is necessary, the most recent Origination Insight Report from Ellie Mae shows: “Time to close all loans decreased in March. The average time to close a purchase fell to 51 days, down from 53 the month prior.” If you’re looking for a quick closing process, there’s never been a market in which the two-step process (finding a buyer and closing the deal) has taken less time. Bottom Line: Selling your house can be daunting, especially in a fast-paced market. However, the fact that we’re in such a strong sellers’ market clearly eliminates many common concerns. Let’s connect today so you can learn more about the opportunities for homeowners who are ready to sell. It's no secret! The housing market in Las Vegas is HOT right now! I'll be honest, you need to be very patient to get a house, but the journey is worth it! Many people are sitting on the fence trying to decide if now’s the time to buy a home. Some are renters who have a strong desire to become homeowners but are unsure if buying right now makes sense. Others may be homeowners who are realizing that their current home no longer fits their changing needs.

To determine if they should buy now or wait another year, they both need to ask two simple questions:

Where will home prices be a year from now? If you average the most recent projections from the major industry forecasters, the expectation is home prices will increase by 7.7%. Let’s take a house that’s valued today at $325,000 as an example. If the buyer makes a 10% down payment ($32,500), they’ll end up borrowing $292,500 for their mortgage. Applying the projected rate of home price appreciation, that same house will cost $350,025 next year. With a 10% down payment ($35,003), they’d then have to borrow $315,022. Therefore, as a result of rising home prices alone, a prospective buyer will have to put down an additional $2,503 and borrow an additional $22,523 just for waiting a year to make their move. Where will mortgage rates be a year from now? Today, mortgage rates are hovering around 3%. However, most experts believe they’ll rise as the economy continues to recover. Any increase in the mortgage rate will also increase a purchaser’s cost. Here are the forecasts for the first quarter of 2022 from four major entities:

The projections average out to 3.6% among these four forecasts, a jump up from where they are today. What does it mean to you if home values and mortgage rates increase? A buyer will pay a lot more in mortgage payments each month if both of these variables increase. Assuming a buyer purchases a $325,000 home this year with a 30-year fixed-rate loan at 3% after making a 10% down payment, their monthly principal and interest payment would be $1,233. That same home one year from now could be $350,025, and the mortgage rate could be 3.6% (based on the industry forecasts mentioned above). That monthly principal and interest payment, after putting down 10%, totals $1,432. The difference in the monthly mortgage payment would be $199. That’s $2,388 more per year and $71,640 over the life of the loan. Add to that the approximately $25,000 a house with a similar value would build in home equity this year as a result of home price appreciation, and the total net worth increase a purchaser could gain by buying this year is nearly $100,000. That’s a small fortune. Bottom Line: when asking if they should buy a home, many potential buyers think of the nonfinancial benefits of owning a home. When asking when to buy, the financial benefits make it clear that doing so now is much more advantageous than waiting until next year. |

About KellyKelly Albright is Broker/Owner of Vision Realty Group and has been in Real Estate for 17 years. She has closed over 700 homes in Las Vegas, North Las Vegas, and Henderson. Archives

August 2022

Categories |

Copyright ©2017

Web Design by Lisa Smith, GEEK GIRLS IN VEGAS

Web Design by Lisa Smith, GEEK GIRLS IN VEGAS

RSS Feed

RSS Feed